The scenario is familiar: it’s getting near the end of a critical quarter or year, and sales are below where they need to be, so the CEO tells the head(s) of sales & marketing to “do something – or else!” If the company sells consumer products, B2B consumables, services or low-cost equipment, there are many options for promotional initiatives that can influence short-run orders: special pricing, ad & email campaigns, sales incentives, coupons, and so on. But if your business is selling a specialist (non-commodity) component of a much higher-value product, many of the classic sales promotion techniques are likely to be ineffectual or counter-productive.

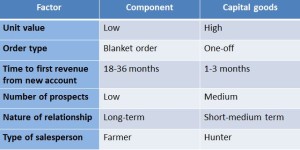

To examine this, let’s look at some of the key differences between a capital good supplier and the vendor of a key component of these goods:

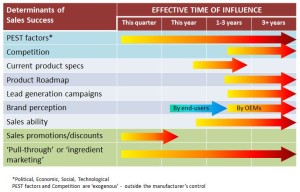

The key difference that can be summarized from this table is that, for the specialist component supplier, it’s all about ‘design wins’. As the vendor, your task is to get the capital goods manufacturer (or OEM – Original Equipment Manufacturer) to design the component into their next generation of product(s). And since the timescale over which the products are developed is typically long, there is nothing you can do to influence this quarter’s sales to new accounts. Other marketing initiatives – lead generation campaigns, improved product specs, new branding, better sales training or whatever – may be perfectly rational for growing the business, but simply cannot help the CEO make this quarter’s numbers.

So, if new account acquisition is not going to help revenues in the near-term, what can you as the component vendor do to increase sales to existing customers? Hiking the price is a possibility, but likely to be difficult in the event that the existing customer is probably buying under a supply contract or ‘blanket order’ (a long-term order with many regular shipments). It may also prompt the customer to look more closely at competitors’ products when it comes to the design of their next-generation of equipment.

The temptation is to go the other way: to lower the price on certain products for a limited period – “This month’s special offer!” This might succeed in driving sales in the short run, but it is likely to be disastrous in the not-much-longer term. Every buyer knows that the best time to buy a new car is at the end of the current model year or the dealership’s financial reporting period. Do you really want to educate them into believing the same is true for your business? Not only is this damaging to your brand, but worse, you are “stuffing the channel”. In other words, unless the OEM has enough additional sales to use up the extra components he has bought on special offer, your products will sit in his inventory instead of yours, and therefore reduce your sales in the next one or more periods until they are used up.

Is there therefore nothing you can do to influence short-term component sales without damaging future prospects? There is, and it takes the form of two related initiatives: a Marketing Development Fund (MDF) and Ingredient Branding. The MDF effectively provides money to the OEM to help them sell more of their products. You might allocate 1-2% of the value of your sales to the OEM (in cash or in kind) to support their advertising, trade shows, sales seminars, and so on that will drive short-term demand for their – and therefore, your – products. In some cases, the component vendor might even collaborate with the OEM to provide sales prizes and other direct incentives to the OEM’s salesforce.

So that you get maximum future value from this discount, you might require that the OEM puts your logo on their promotional materials, and you might tie this in with your own Ingredient Branding campaign. There is no room to explore Ingredient Branding in depth here, but the classic ‘Intel(TM) Inside’ campaign gives the general idea. Intel’s CPUs were a crucial but invisible component of PCs made by a variety of OEMs, but Intel successfully promoted its technology directly to consumers, and through joint marketing with its OEM customers, to make its products not only visible but apparently essential for discerning buyers. GoreTex(TM) is another example of similar Ingredient Branding.

This table summarizes the various factors that can influence sales in the short, medium- and long-term:

To summarize: the assumption here is that a new product takes 12-18 months to come to market, so the component vendor sees no sales benefit from a ‘design win’ for that period. Discounting is likely to be counter-productive in the longer term, whereas ‘pull-through’ marketing that drives sales of an existing customer’s products can drive sales in a much shorter timescale. Marketing Development Funds stimulate this pull-through, and Ingredient Branding can add a strategic element of value.